what is maryland earned income credit

The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. It is the nations most effective anti-poverty program.

Why We Should Expand The Earned Income Tax Credit Prosperity Now

Earned Income Tax Credit The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

. You must file taxes. Employees who are eligible for the federal credit are eligible for the Maryland credit. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. The Earned Income Credit EIC is a tax credit for certain people who work and have earned income below a certain amount.

By Angie Bell August 15 2022 August 15 2022. In 2019 25 million taxpayers received about 63 billion in. R allowed the bill to take effect without his signature.

The earned income tax credit EITC is a refundable tax credit designed to provide relief for low-to-moderate-income working people. Earned Income Credit EIC is a tax credit in the United States which benefits certain taxpayers who have low incomes from work in a particular tax. The Earned Income Tax Credit also called the EITC is a benefit for working people with low-to-moderate income.

If you qualify for the federal earned income tax credit and claim. Earned Income Credit - EIC. EITC is a tax benefit for low-and moderate-income workers worth up to 5751 for families.

9 hours agoThese inflation adjustments are some of the biggest adjustments made in history that will change individual income tax brackets and increase some key tax deductions and. The maximum federal credit is 6728. It is a special program for low and moderate-income persons who have been employed in the last tax year.

How Much Is The Earned Income Credit In Maryland. To qualify for the Earned Income Credit in 2022. Earned Income Tax Credit.

An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov. The maximum federal EITC amount you can claim on your 2021 tax. If you qualify for the federal earned income tax credit and.

If you qualify for the federal earned income tax credit and. The program is administered by the Internal. If you qualify you can use the credit to reduce the taxes you owe.

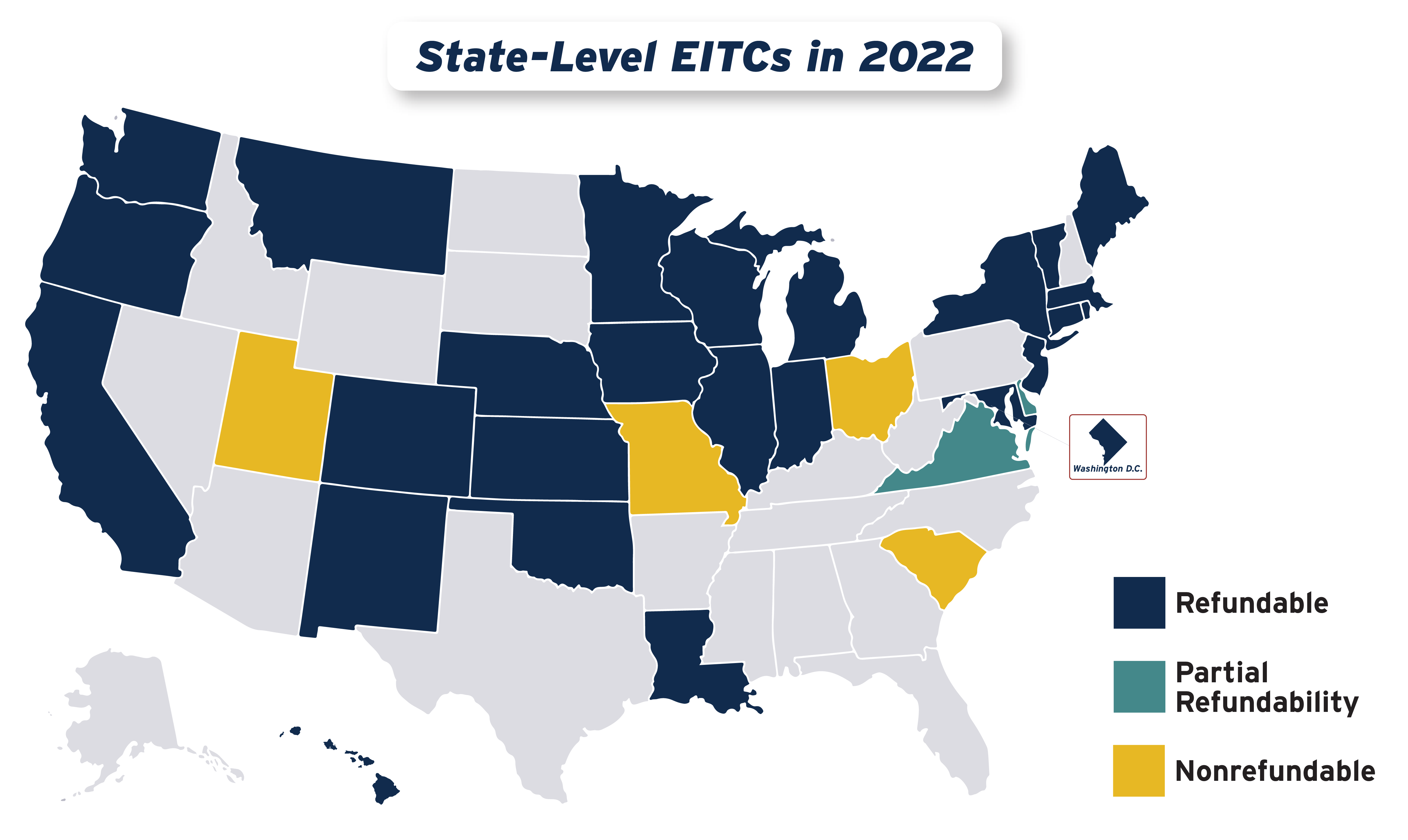

Married employees or employees with qualifying children may qualify for up to half of. Eligibility and credit amount depends on your income. 36 rows States and Local Governments with Earned Income Tax Credit States and Local Governments with Earned Income Tax Credit More In Credits Deductions.

It is different from a tax deduction which reduces the amount of. What is the Earned Income Credit.

Gov Larry Hogan Announces 1b Covid 19 Relief Act Includes 750 Income Tax Credit For Maryland Families Cbs Baltimore

Expanding Maryland S Earned Income Tax Credit Will Benefit Families And The Economy Maryland Center On Economic Policy

New 2022 Maryland Tax Relief Legislation Passed Sc H Group

If You Are A Nonresident Employed In Maryland But Living In A Jurisdi

Maryland Senate Oks Tax Credit For Immigrants Nbc4 Washington

Form 502x Amended Maryland Tax Return Youtube

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

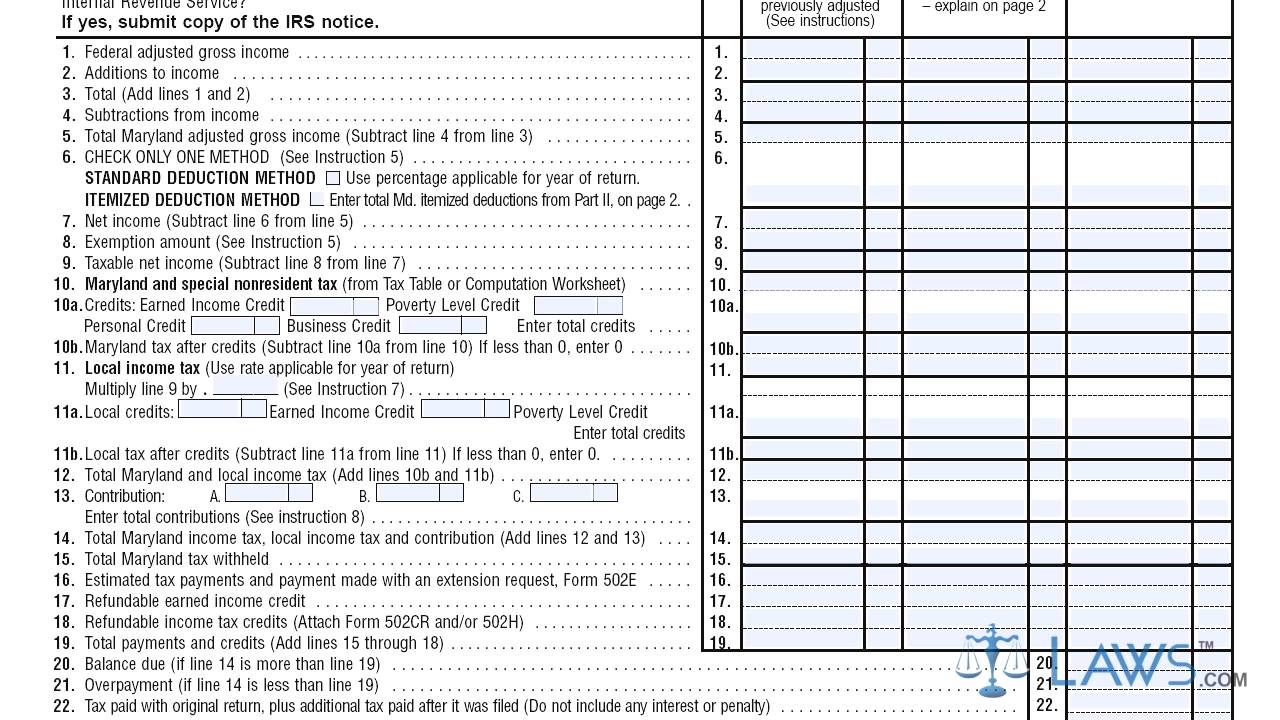

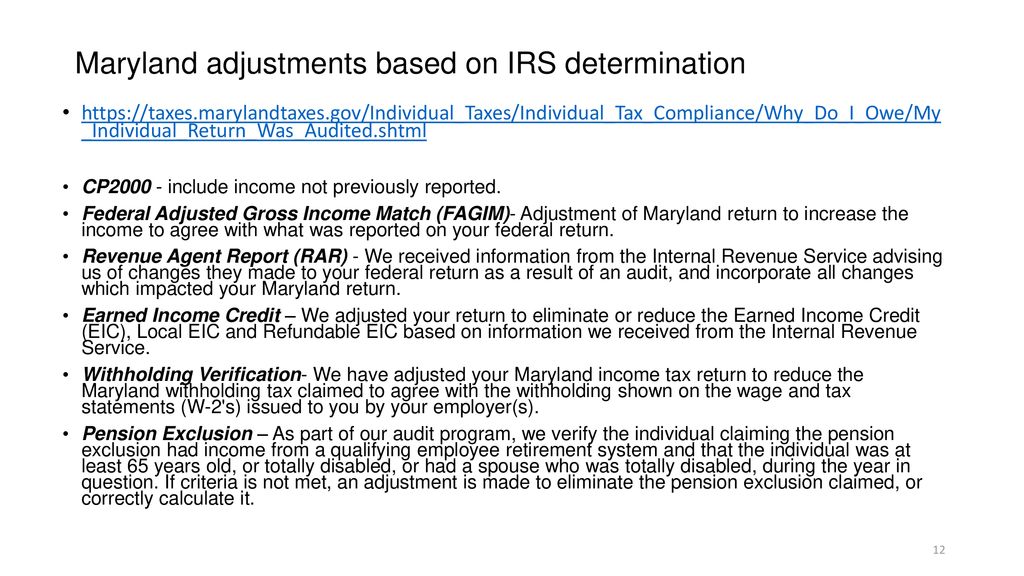

Maryland Audits Victoria Eve Kelly Esq Victoria Eve Kelly Llc Ppt Download

Maryland Refundwhere S My Refund Maryland H R Block

Louisiana Update April 2021 All In One Poster Company

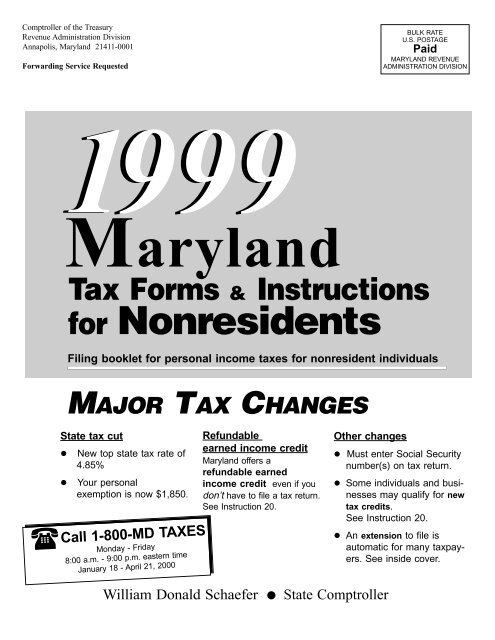

For Nonresidents The Comptroller Of Maryland

Expanding The Maryland Earned Income Tax Credit Eitc Sign On Survey

Earned Income Tax Credit Potomac Companies

Introduction To Tax Law Part 6 Earned Income Credit 2022 Youtube

Maryland Income Taxes Are Due This Friday Eye On Annapolis Eye On Annapolis

2022 State Tax Reform State Tax Relief Rebate Checks

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

Maryland Volunteer Lawyers Service Eitc Can Give Qualifying Workers With Low To Moderate Income A Substantial Financial Boost To Receive The Credit People Must Meet Certain Requirements Use The Irs Eitc Assistant To Check