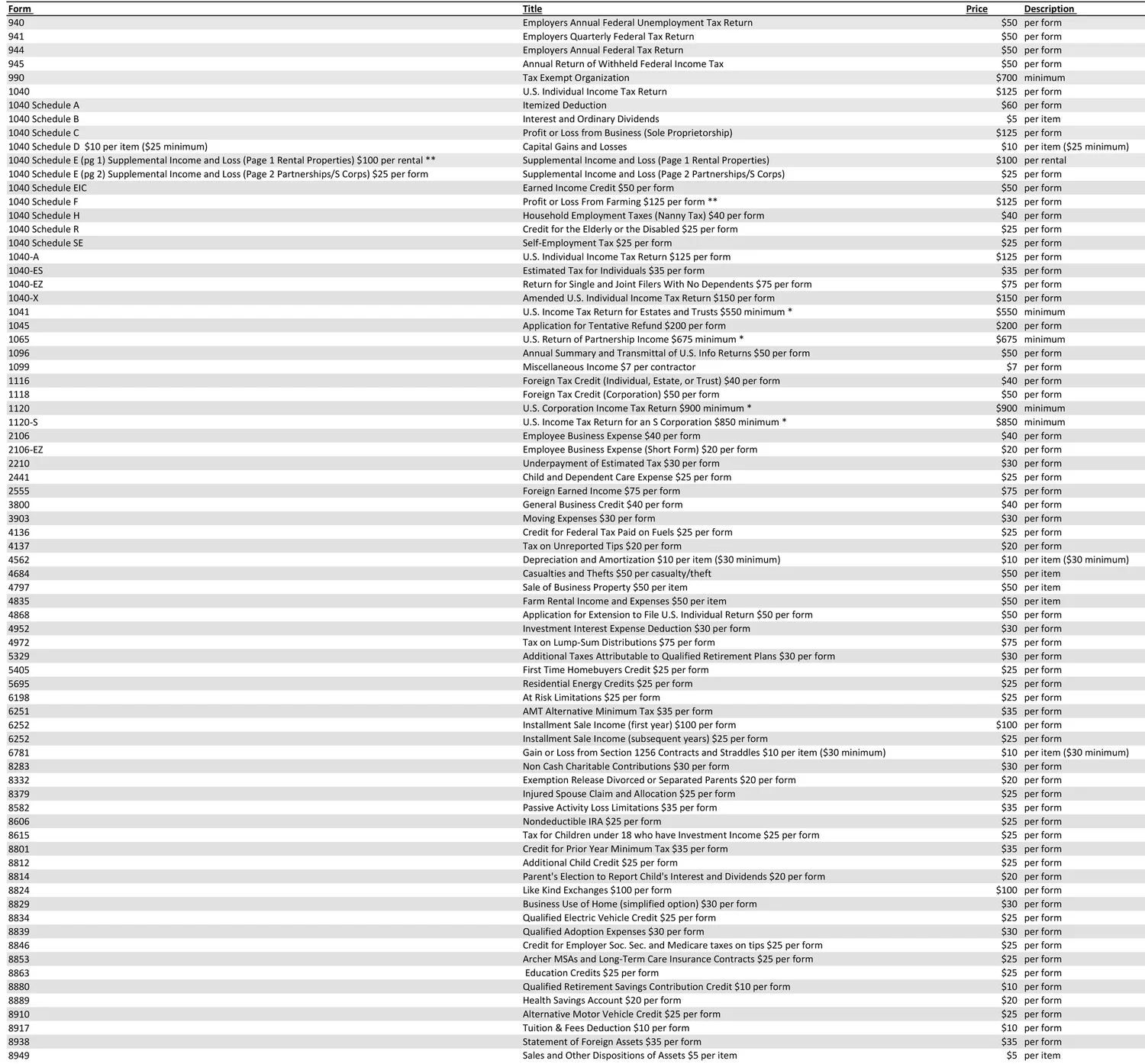

tax preparation fee schedule 2019 pdf

Schedule C Small Business Income includes Sch SE starting at 125. Form 1040 page 1 and 2 not including state return 75.

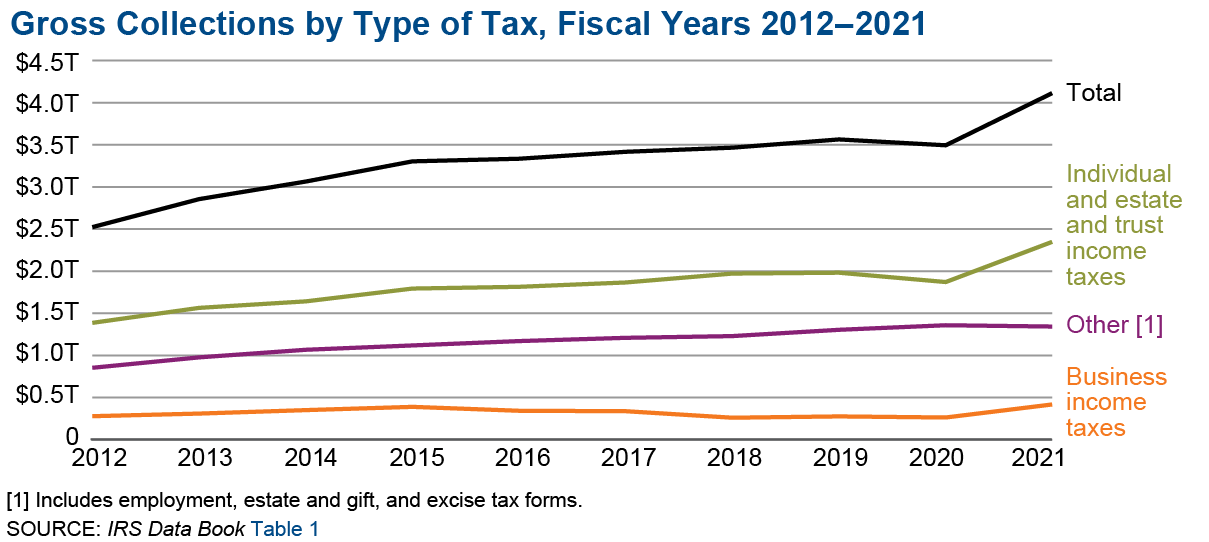

The Tax Cuts And Jobs Act S Effect On Tax Preparation Behavior

Schedule F each 15000.

. Schedule E - Supplemental Income and Loss 115 Each 125 Each Rental Properties Schedule E P. Tax Preparation Checklist 2021 Pdf. Schedule EIC - Earned Income.

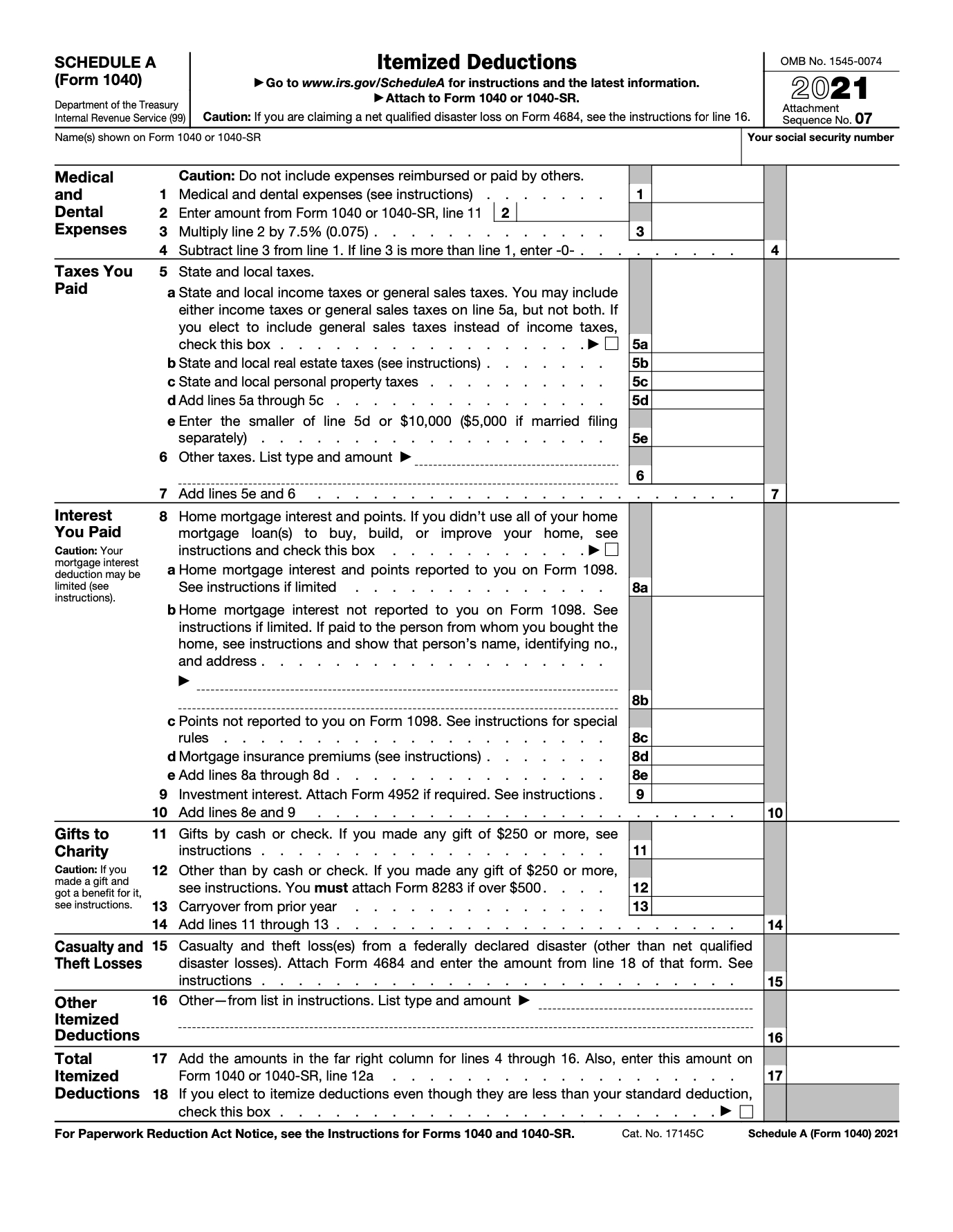

State Return 80 per state. Schedule A Itemized Deductions starting at 25. LERGY TAX PROFESSIONALS Susan K.

Tax preparation fees on the return for the year in which you pay them are a miscellaneous itemized. Form 4562 - Depreciation Amortization. Tax details schedule enter your advance tax and self- assessment tax only in the schedule SCH IT Then in Tax Paid.

Federal Return up to 4 W-2s 125. Find The Federal And State Income Tax Forms You Need For 2019 Official Irs Tax Forms With Instructions Are Printable And Can Be Income Tax Irs Taxes Tax Forms Fillable. Schedule A Itemized Deductions starting at 25.

Business returns start at. 895 Includes business sole proprietorsingle member LLCrental. Schedule B Interest and Dividends 25 per every.

For new clients a 150 deposit is required in advance of tax preparation. Form 1040 ES Estimated Tax Vouchers. Tax preparation fee schedule 2019 pdf Sunday March 6 2022 Edit.

Tax Return Fee Schedule. Depreciation Schedule each item 500. LERGY TAX PROFESSIONALS Susan K.

You should include this deduction on. Schedule SE - Self-Employment Tax. Year-round services are available including representation tax notices tax planning consultation and new or revised estimates.

Valid receipt for 2016 tax preparation fees from a tax. Level 1 starts at. 2019 NATP Tax Professional Fee Study 15 Fee Structure.

Rate of 75 per hour. The actual fee and other important details are clearly stated in the engagement agreement that must be executed usually via email before we start work. Individual tax returns start at.

As of December 2019 irsgov httpswwwirsgovpubirs-pdfp529pdf. 595 With no business or rental activity. Early Bird Discount of 10 applied for.

BusinessFiduciary Returns Minimum Fee Plus Cost Based on Complexity of Return 2018 2019 New client 380 366 Returning. Fee Schedule January 2019. 2 - Supplemental Income and Loss.

2022 lc prep fees 2022 tax preparation fee schedule cost each. Individual Income Tax Return. Schedule K-1 each 2500.

Tax document checklist use this checklist as a helpful reference as you gather your tax documents. LERGY TAX PROFESSIONALS Susan K. Same as a above but with rental or pass through income sched e.

Estimated Tax Payments Calcs. Better yet attach the list to a folder of. Amended Returns fees for additional forms may apply 15000.

Resources Better Accounting Financial Resources

Income Tax Planning And Compliance Pisenti Brinker

2019 Clergy Tax Organizer Pdf Download Clergy Financial Resources

Civil Service Association Dos Documents General Services Administration Rule Federal Travel Regulation Taxes On Relocation Expenses Relocation Expense Reimbursement Fr Document 2019 25411 Citation 84 Fr 64779 Pdf Pages 64779 64783 5 Pages

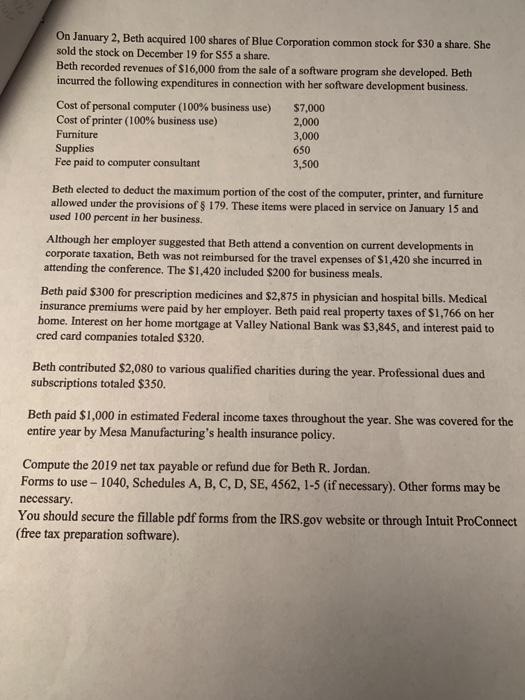

Solved Beth R Jordan Lives At 2322 Skyview Road Mesa Az Chegg Com

2019 Small Business Tax Accounting Checklist Free Pdf

Free Tax Preparation Assistance Goochlandcares

Ky Revenue Form 10a100 Fill Out And Sign Printable Pdf Template Signnow

1040 2021 Internal Revenue Service

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Soi Tax Stats Irs Data Book Internal Revenue Service

What Is The Cost Of Tax Preparation Community Tax

This Additional Information Has Been Provided To Be Chegg Com

Average Income Tax Preparation Fees Guide How Much Does It Cost To Get Your Taxes Done Tax Services Fees Average Cost Of Tax Preparation Advisoryhq

Normal Tax Return Preparation Fees Genesis Tax Consultants

Schedule A Form 1040 Itemized Deductions Guide Nerdwallet

2022 Car Donation Tax Deduction Information

Federal Register Medicare Program Cy 2022 Payment Policies Under The Physician Fee Schedule And Other Changes To Part B Payment Policies Medicare Shared Savings Program Requirements Provider Enrollment Regulation Updates And