what is a secondary property tax levy

In addition due to increased property values the current secondary tax rate of 05042 is expected to decrease by 00941 to 04101 per 100 of. A municipal portion and an education portion.

35-458 for the purpose of retiring the debt associated with the Surprise General Obligation Bonds which were approved by voters on November 7 2017.

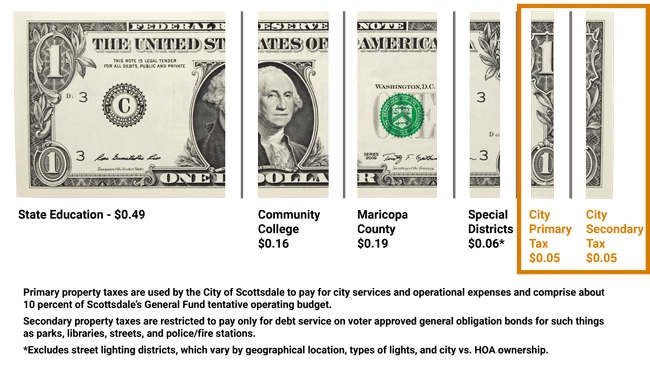

. Secondary Property Tax SEC. Special districts 000 Total 015. 2020 TAX LEVY TABLE OF CONTENTS Note.

The citys proposed secondary property tax levy will decrease 502 million due to use of accumulated fund balance as a result of savings achieved through a general obligation debt refinancing. A Tax Levy is the amount of money to be raised by property taxation and is reported annually by each district residents approve the tax levy. Debt service for fiscal year 2020-21 on the Public Safety Training Facility under construction in Gilbert is one item that would be covered.

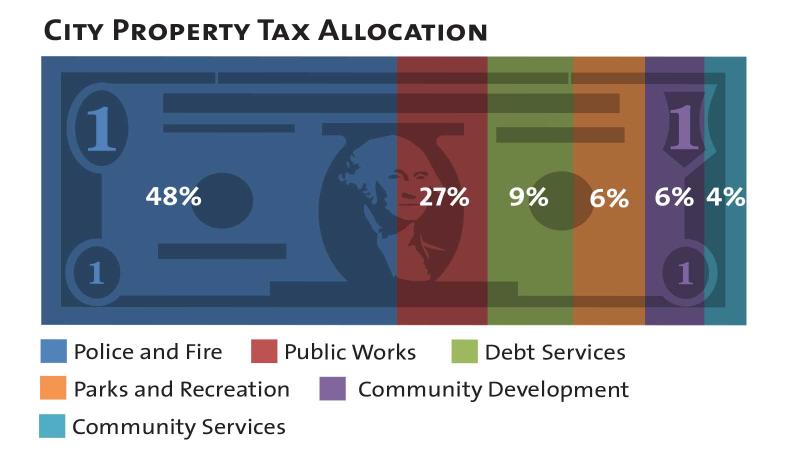

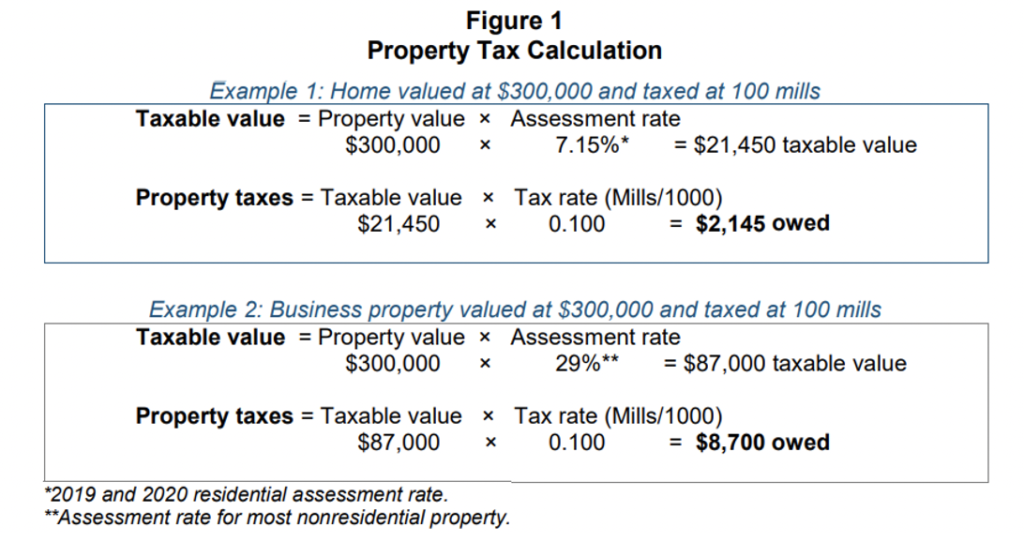

The secondary property tax is used to cover the annual debt service payments and related administrative feesexpenses. The tax levy is calculated using the formula to the right. The value of each property in the City is determined annually by either Maricopa County or the State.

Secondary Property Tax Levy debt repayment. In a two-tiered municipality a component of the rate is set by the upper-tier and a component is set by the lower-tier municipality. The act of imposing a tax on someone is called a levy.

Secondary Property Tax SEC. Since 2006 the amount of the secondary property tax levy has ranged from 008 cents to 019 cents per 100 of assessed value and the total amount collected has gone from 40 million to this year. Property tax has two components.

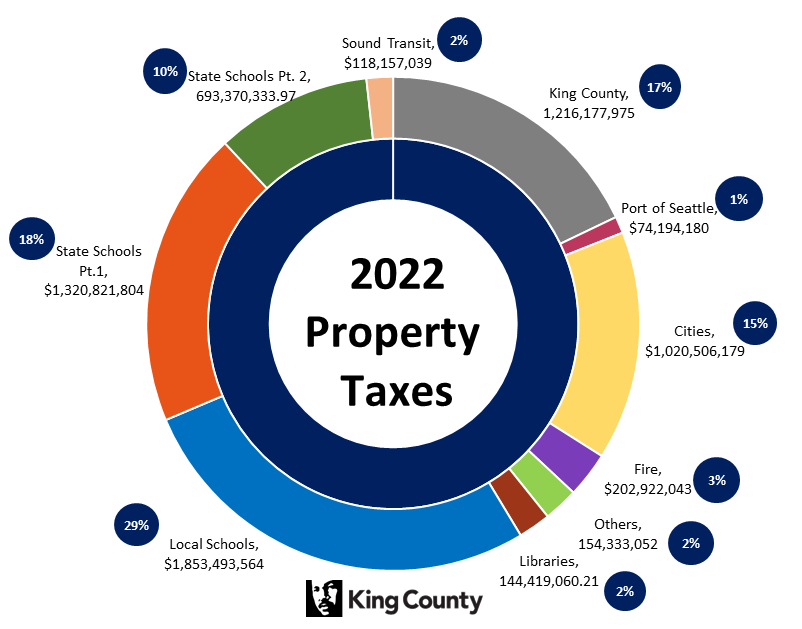

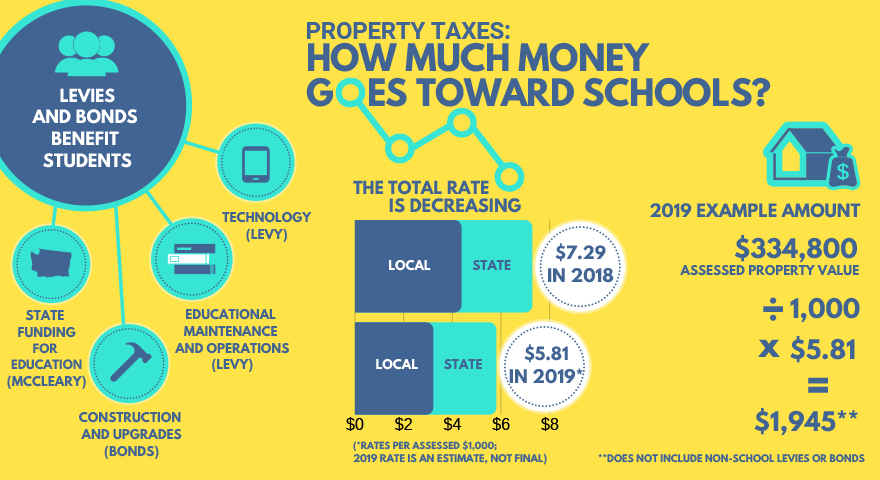

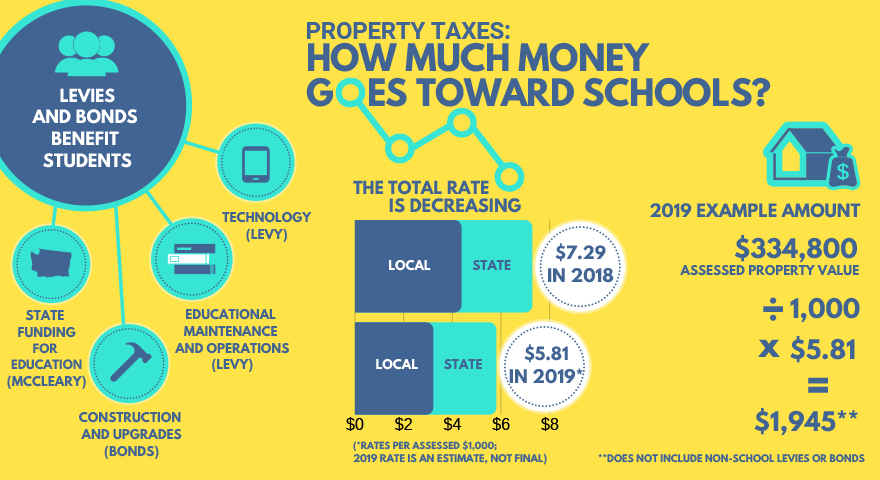

While the rate is unchanged the total levy amount will increase due to new construction and increased assessed valuations on existing property. FY 202021 Tax Levy chg. EHB 2242 changed the state school levy from a budget based system limited by the one percent growth to a 270 per 1000 market value rate based property tax for the 2018 2021 tax years.

A city or town may levy whatever amount of secondary property taxes is necessary to pay general obligation debt. The Internal Revenue Service IRS can impose levies on taxpayers to satisfy outstanding tax debts. Levies are different from liens.

Certain districts levy based on acreage Numbers 5 19 such as Electrical Water and Irrigation versus valuation. Where does Internal Revenue Service IRS authority to levy originate. AMPHI DESEGREGATION and TUSD DESEGREGATION adopted as secondary property taxes but included in computing the State Aid to.

42-11001 Subsection 7b now requires using the Limited Property Value Net Assessed Value in determining and levying primary and secondary property taxes on. School district 015. A property tax levy is the right to seize an asset as a substitute for non-payment.

ESSB 6614 changed the rate based levy from 270 per 1000 market value to 240 per 1000 market value for the 2018 tax year. A tax levy is the amount specific in dollars that a taxing unit city town township etc may raise each year in property tax dollars. Property taxes are one of the primary if not the only ways for municipalities to raise revenue for community services.

The rates for the municipal portion of the tax are established by each municipality. 301 West Jefferson Street Phoenix Arizona 85003 Main Line. The secondary tax is calculated using the Limited Value of your.

The FY 202021 annual secondary property tax. The City uses the tax levy not the tax rate to manage the secondary property tax. In other words the levy is the cap on the amount of property tax dollars a local government is allowed by law to collect.

FY 202021 Tax Levy chg. Written Report Supporting the Tax. A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to satisfy the tax debt.

The City of Surprise will levy a secondary property tax. The secondary tax is comprised mainly of commitments to satisfy bond indebtedness of jurisdictions fund voter-approved budget overrides and to support the operations of the special taxing districts such as fire flood control street lighting and other limited purpose districts in which your property is located. FY 202122 Tax Rate per 100 NAV FY 202021 Tax Rate per 100 NAV.

Governments enforce a property tax levy as a measure of last resort. A levy is a legal seizure of your property to satisfy a tax debt. Towns and cities use the proceeds from levying property taxes to fund the.

Levies are different from liens. Market value -based tax. The idea of a levy is that the government will take the property because you are unable.

Levy property taxes upon the property. The City of Surprise will levy a secondary property tax pursuant to Ariz. The Pima County Property Tax Help Line can answer questions about how your property tax was calculated.

Comprised of the total of the obligation for Special Taxing Districts voter approved bonds and budget overrides that are assessed on valuation. The City will levy a secondary property tax each year until the General Obligation debt has been retired. Refer to number 4.

A Tax Rate is is the percentage used to determine how much a property owner will pay per one hundred dollars of net assessed value. A property tax levy is the right to seize an asset as a substitute for non-payment. Therefore not paying your property taxes can result in the government seizing your property as payment.

Starting in Tax Year 2015 Proposition 117 and ARS. Property tax is a levy based on the assessed value of property. What is an assessed value.

14 Special District Tax. The City of Surprise is proposing to hold the secondary property tax rate at 34771 for tax year 2022. A tax rate is figured by dividing the total secondary property tax levy by the total assessed value in town to determine each property owners share of the levy.

Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on general obligation bonded indebtedness. Another tax that is levied on property owners is a property tax which is. Multiply estimated market value by total market value tax rate to determine the.

The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with General Obligation Bonds. Add the net tax capacity -based tax to the market value-based. Failure to pay your property taxes can result in fines penalties interest and even the seizure of your property.

2018 County Property Tax Report Texas County Progress

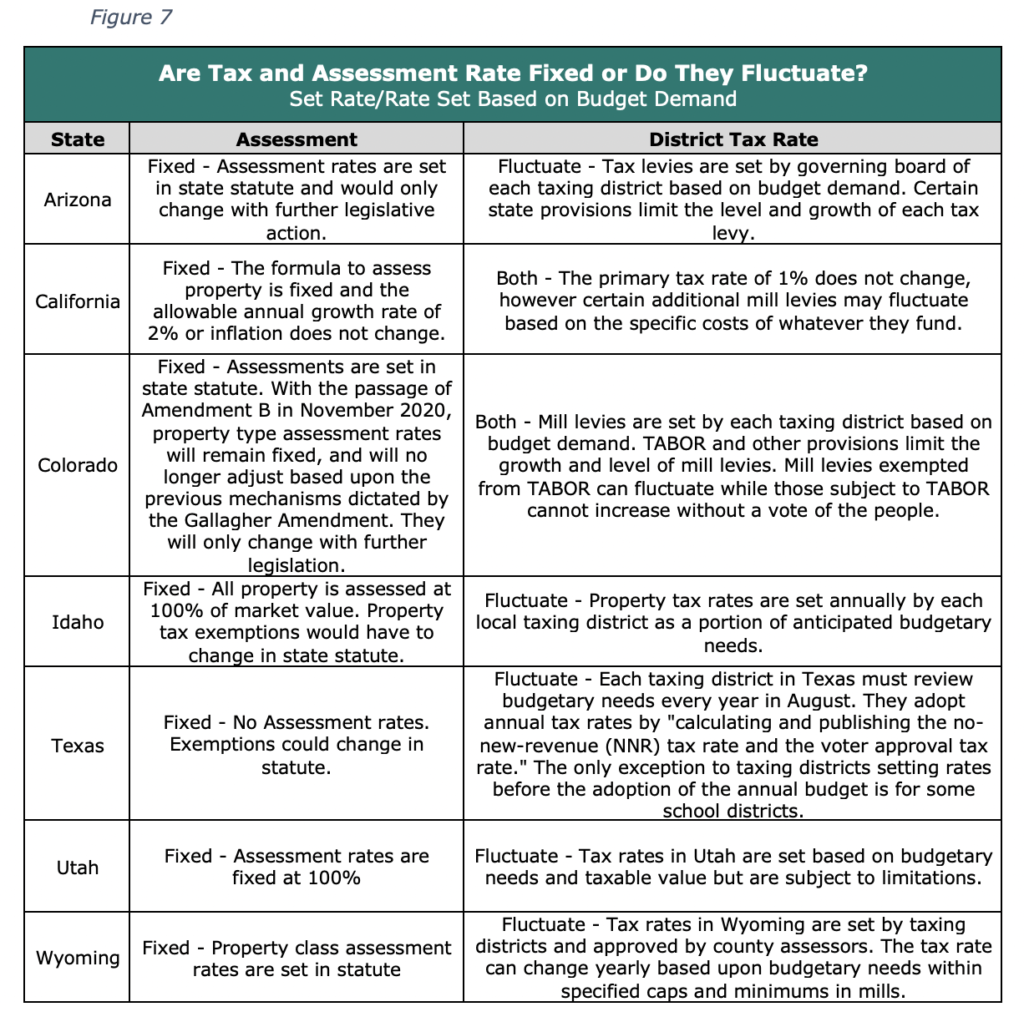

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Demystifying Utah S Property Tax Law And Why We Have The Best Property Tax Laws In The Nation Utah Taxpayers

Property Tax Changes Vancouver Public Schools

City Of Scottsdale Truth In Taxation Notice

Council Approves 2022 Tax Levy City Of Bloomington Mn

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Biennial Property Tax Report Texas County Progress

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Weld County Mill Levy Rate Continues To Shrink Especially Relative To Neighboring Counties Greeley Tribune